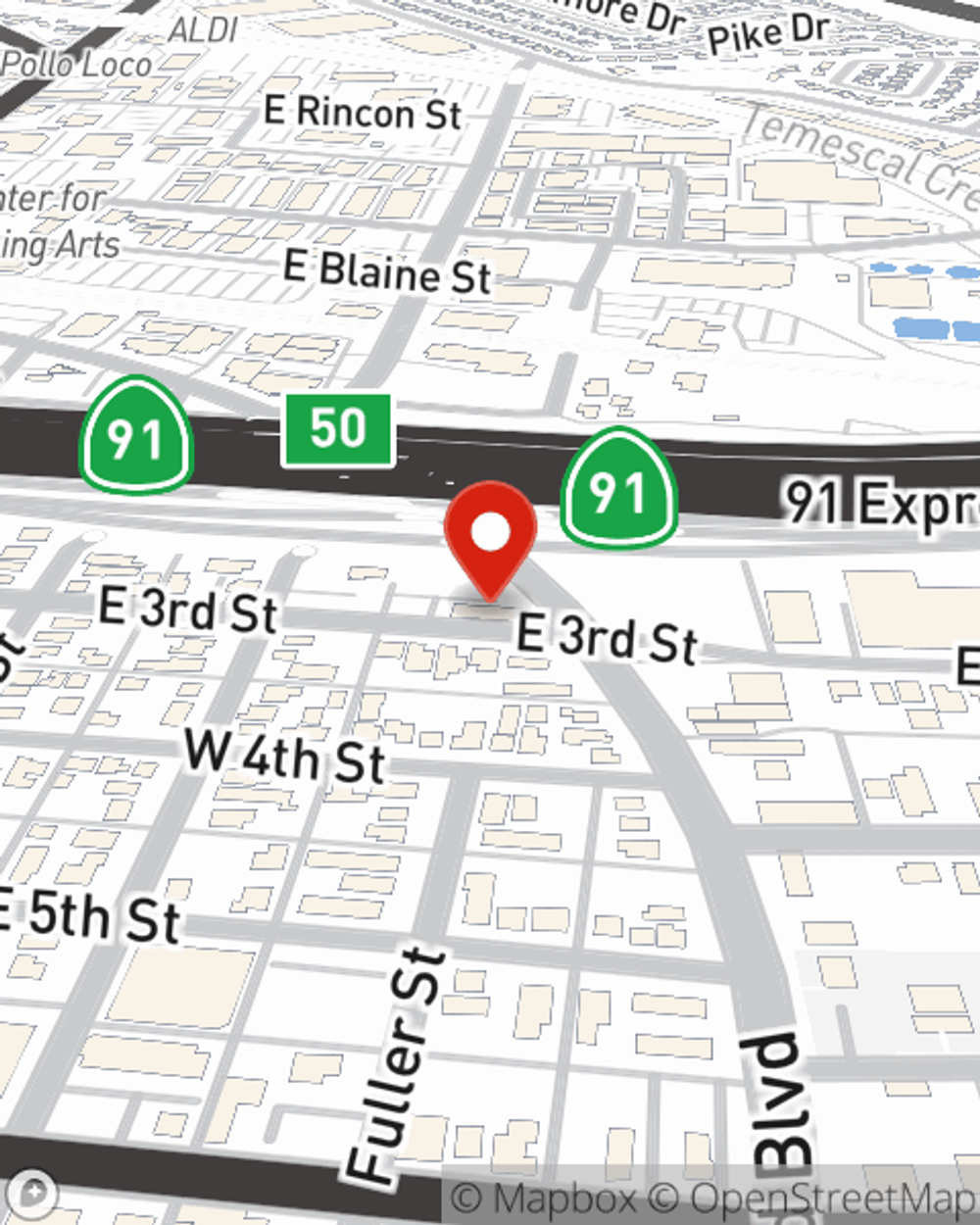

Life Insurance in and around Corona

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

One of the greatest ways you can protect the ones you hold dear is by taking the steps to be prepared. As uneasy as considering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Their Future Is Safe With State Farm

Having the right life insurance coverage can help loss be a bit less debilitating for your loved ones and provide space to grieve. It can also help cover current and future needs like car payments, grocery bills and medical expenses.

When you and your family are insured by State Farm, you might sleep well at night knowing that even if the worst comes to pass, your loved ones may be covered. Call or go online now and see how State Farm agent Jesse McArthur can help you protect your future.

Have More Questions About Life Insurance?

Call Jesse at (951) 356-4906 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Jesse McArthur

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.